More than a million foreign nationals in Britain are claiming £1 billion per month in taxpayer-funded benefits.

Households with at least one claimant who is a foreign national received £941 million in March this year, up from £461 million in March 2022, representing nearly a sixth of the month’s Universal Credit payments.

In 2023, households with at least one foreign national claimant received more than £7.5 billion in Universal Credit.

Three nationalities — Congolese, Iraqis, and Afghans — claimed benefits at four times the rate of British people.

Of the 200 nationalities, Poland accounted for the largest number of claimants at 89,040, followed by Pakistan (85,881), Bangladesh (54,589), Romania (45,727), India (33,561), Portugal (32,063), Nigeria (23,627) and Ireland (17,933).

The Congo had the highest rate, at 445 claims per 1,000 of its population in the UK, based on 2021 census figures from the Office for National Statistics.

It was followed by Iraq at 434 per 1,000, Afghanistan (414), Algeria (361), Eritrea (355), Syria (352), Somalia (336), Iran (334), Morocco (286) and Slovakia (283). The average for the UK was 100 per 1,000 of the population.

Why am I paying taxes to battery farm the indolent from the third-world?

Data from Denmark and the Netherlands shows that these Indian, Nigerian, and MENAPT (Middle Eastern, North African, Pakistan, and Turkey) immigrants are, in aggregate, never net tax contributors across their lifetimes. Disconcerting for those who insist that the problem is purely one of integration is that their children, the second-generation immigrants born in the host countries, are not net contributors either. They retain the culture, criminal proclivities, and work patterns of their parents. Non-EU migrants and their descendents in the Netherlands were an annual cost of €27 billion between 2016 and 2019; €400 billion net between 1995 and 2019. By contrast, Western European, East Asian, and Anglosphere migrants were annual net contributors to the tune of €1 billion.

This is entirely predictable. Just look at the countries they’re coming from. The people precede a country and the economy, not the other way around. But because of the ruling class’ Luxury Belief religion of antiracism, they refuse to factor this into immigration policy.

When asked why foreign nationals are being battery-farmed at British taxpayers’ expense, a Department for Work and Pensions spokesperson told The Telegraph, “We have a duty to pay benefits to all those entitled to receive them.”

This is the prevailing view across government, the civil service, the police, the courts, and elite culture. As Lord Gus O’Donnell, former Cabinet Secretary under Blair and Brown, told David Goodhart, “‘When I was at the Treasury I argued for the most open door possible to immigration … I think it’s my job to maximise global welfare not national welfare.”

They think our home is the world’s poor-box, and will plunder our pockets until there’s no thread left to pay for it.

Hard-working, law-abiding, tax-paying young professionals are being squeezed in a vice between the state’s dependent foreign client groups, receiving disproportionate amounts of taxpayer subsidies, and property-owning Boomers, who are net beneficiaries of welfare programmes they paid less into than present taxpayers, in the form of the NHS and pension system.

Hence the following meme:

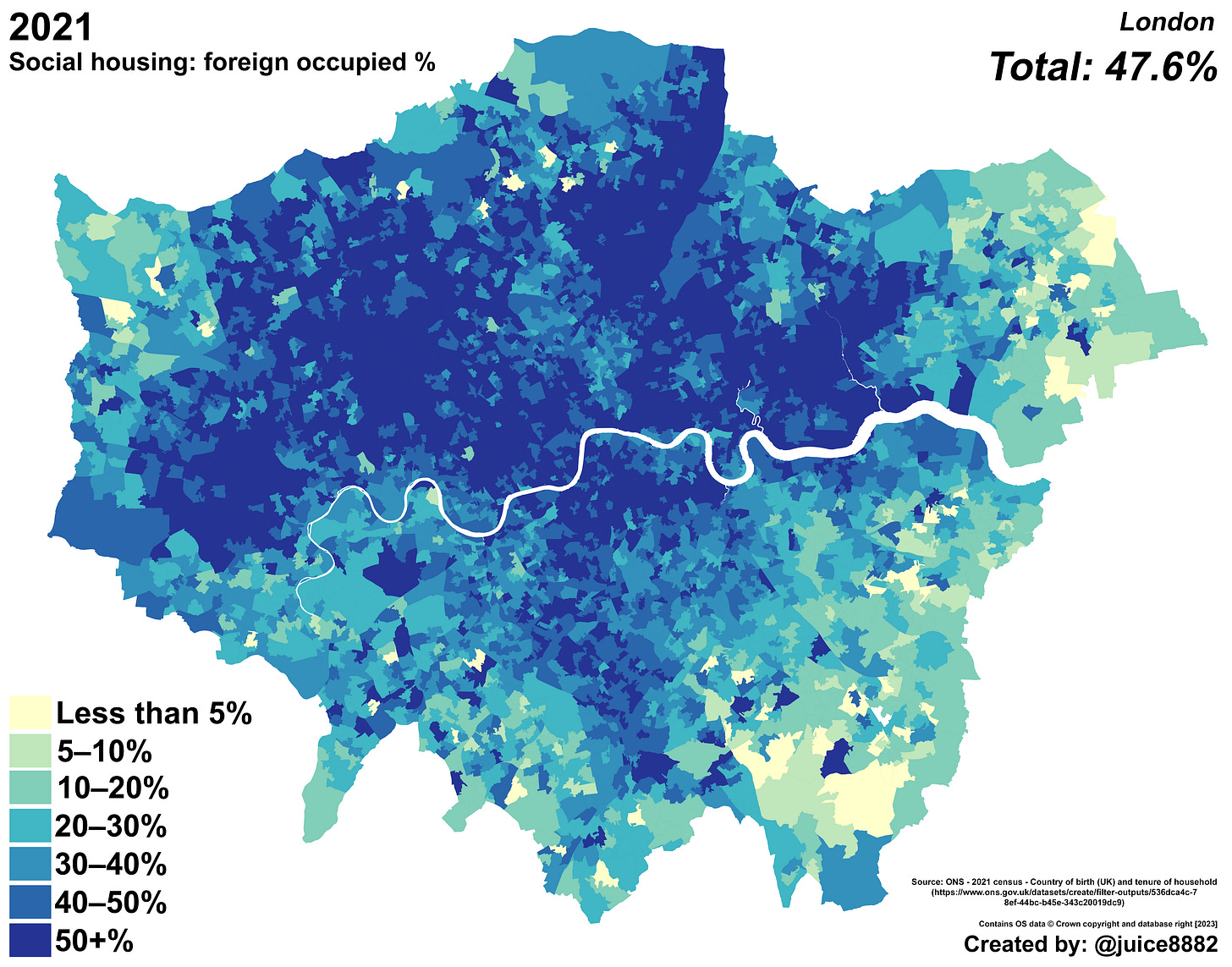

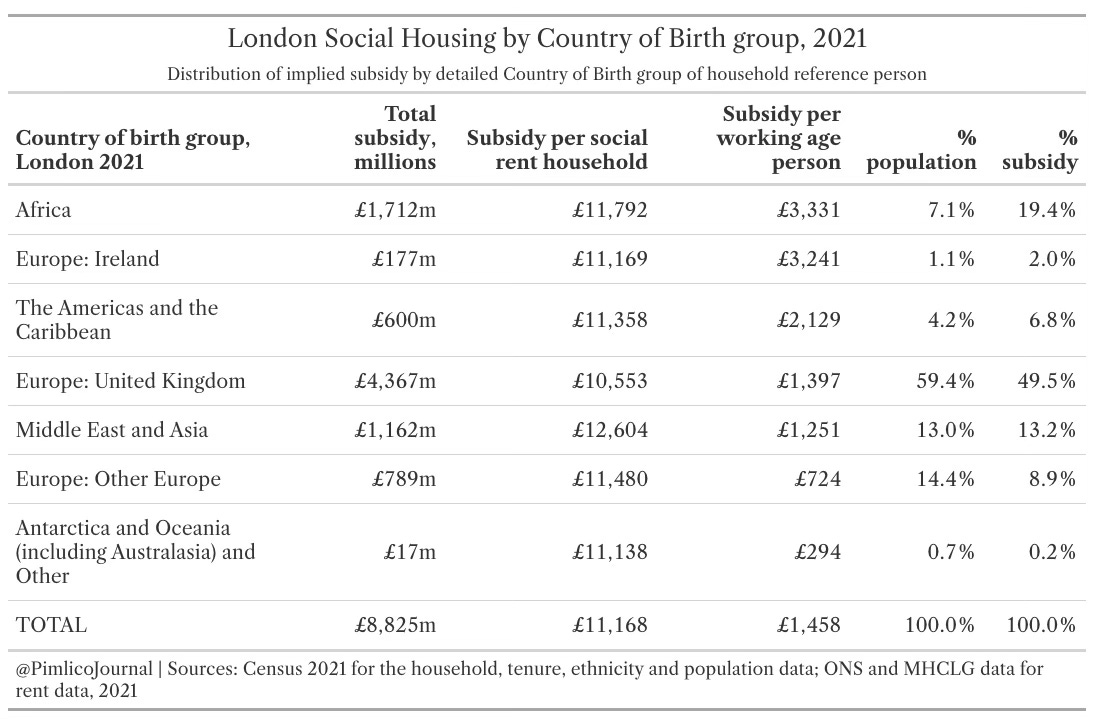

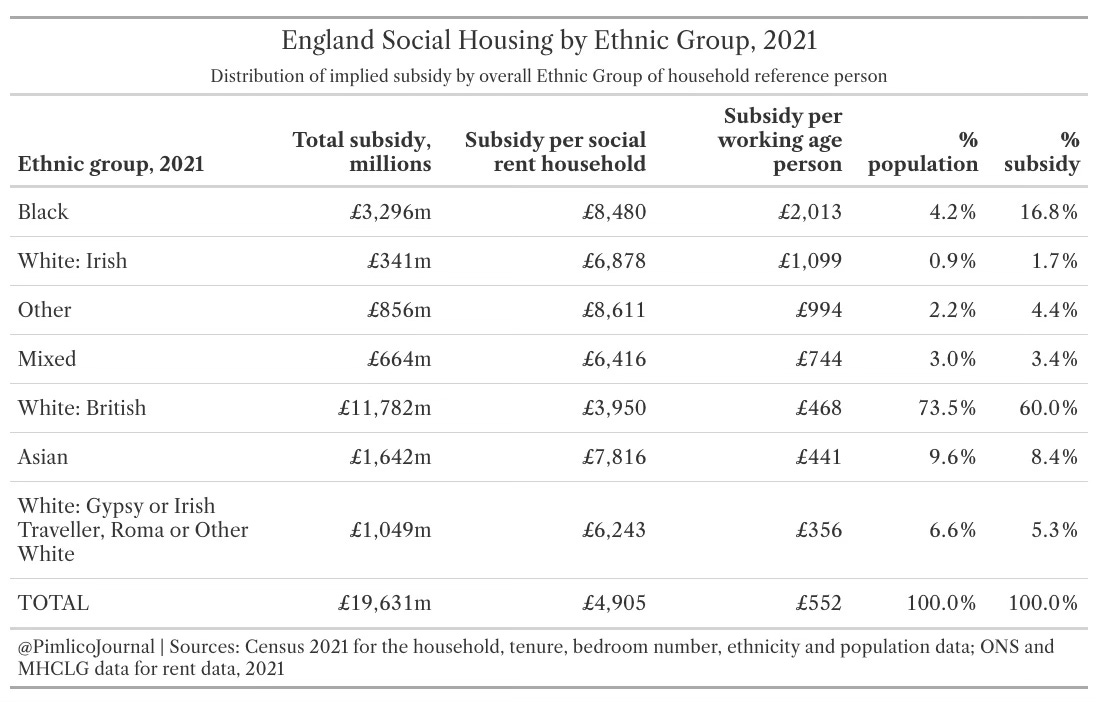

Karim, 25 is a second-generation immigrant who lives in social housing, and will always live in social housing. In 2021, black households (4 percent of England’s population) were the largest beneficiaries of social housing subsidies (17 percent), at £3.3 billion. 47.6 percent of social housing stock in London was occupied by a foreign-born person(s) in 2021. This was before the Boriswave of net-tax-taking immigration.

Karim’s contribution to Britain is best summarised by the following anecdote from former Reform UK comms manager Gawain Towler — who had his phone stolen by some GDP contributors last week:

The damage? Oh, it was glorious. The thieves splurged £1400 at Sneakersz (Santander, please, I haven’t worn trainers since the 90s), £6000 to Western Union, and a smattering of petty purchases. Then, the gut punch: my crypto stash — gone. I was broke, stranded outside a prison, a modern-day pauper in a cashless dystopia.

These are the denizens of YooKay’s urban dystopia. They commit crimes to spend disposable income on luxury status goods. They evade public transport fares, breaking through barriers and boarding buses with the implicit understanding that they will escalate to lethal violence if challenged.

Listen to this episode with a 7-day free trial

Subscribe to Tomlinson Talks to listen to this post and get 7 days of free access to the full post archives.